Introduction

The Indian stock market, an amalgamation of exchanges providing a platform for the buying and selling of securities, can safely be heralded as the heart that pumps financial growth into the nation’s economy. Operating in an often fast-paced and dynamic ecosystem, it gives companies access to capital in exchange for giving investors a slice of ownership in the business.

Recently, the stock market hit a milestone that captured national and global attention. The India SENSEX stock market index, a BSE indicator of the performance of 30 well-established and financially sound companies, touched an all-time high in 2023. This record-breaking feat opens up discussions about the market’s vibrant journey since its inception, the milestones achieved, the crises surpassed, and the evolution it has undergone over the years.

In this comprehensive article, we embark on a voyage back in time to trace the lineage of the Indian stock market, comprehending its origins and unearthing the chronicles of its growth over centuries that led it to this momentous achievement.

Origins of the Indian Stock Market

Historical Background: East India Company and the First Stock Exchange in India

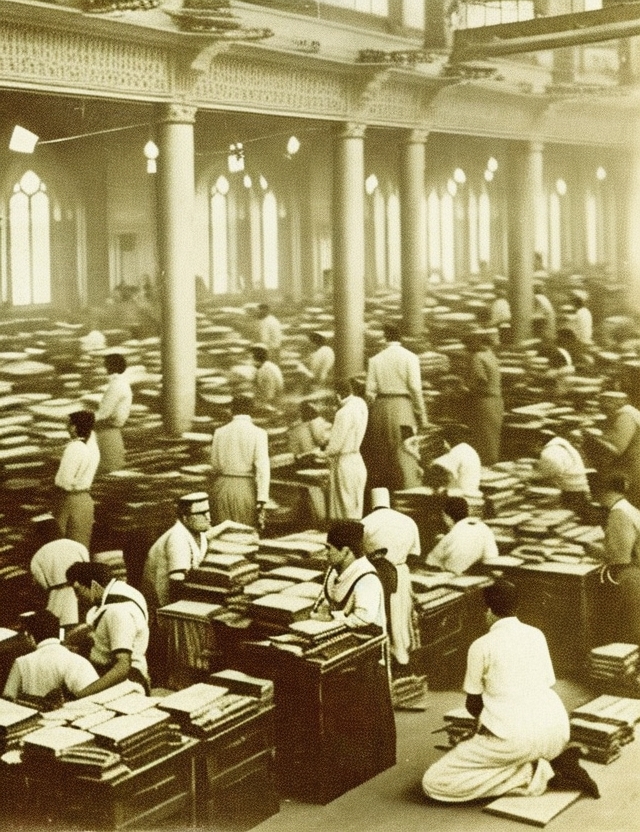

The story of the Indian stock market traces back to the British colonial era when the East India Company laid the groundwork for modern-day stock trading practices. The inception of stock trading in India can be attributed to the late 18th century when the East India Company dominated the commercial landscape, trading commodities and exchanging shares. In 1830, the first community of brokers gathered to trade securities under a banyan tree in the bustling area of Mumbai. This informal gathering of traders, in its nascent stage, paved the way for the creation of India’s first stock exchange.

The Establishment of the Bombay Stock Exchange (BSE) in 1875

The Bombay Stock Exchange (BSE) was established in 1875, as the first organized stock exchange in India, which formalized the way trades were executed. From a beginning of 22 stockbrokers trading under a banyan tree, the BSE transitioned into a formal exchange, providing a well-structured platform for buying and selling securities. Over the years, the BSE has solidified its status as a prime stock exchange in India, evolving into the marketplace that it is today, with equity, derivatives, currency, and other trading segments.

The Birth of Other Regional Stock Exchanges

Following the trajectory of the BSE, other regional stock exchanges mushroomed across the country. The Calcutta Stock Exchange, founded in 1908, held prominence as the second-oldest exchange in South Asia. The Madras Stock Exchange, initiated in 1937, emerged as another vital regional player in the stock market. The introduction of the Delhi Stock Exchange, along with other regional exchanges, contributed to the development of a vibrant financial ecosystem. The eventual consolidation of these regional stock exchanges led to the formation of the Inter-Connected Stock Exchange (ISE) in 1998, aggregating market activities and further expanding the trading landscape.

The rich tapestry of the Indian stock market, stemming from historical trading practices and the development of stock exchanges, highlights the market’s early beginnings and how it paved the way for remarkable progress and expansion in the years to come.

Evolution of the Indian Stock Market

The Indian stock market has undergone an extraordinary transformation from its infancy to the present day dynamic trading platforms.

Transformation From Trading under a Banyan Tree to Modern Stock Exchanges

While the initial days of trading were marked by standing under the shade of a banyan tree in Mumbai, the evolution has been to sophisticated, fully automated, screen-based trading.

| Era | Trading Place |

|---|---|

| Late 1800s | Brokers gather under a banyan tree |

| Early 1900s to Late 1900s | Trading on the floor of Bombay Stock Exchange |

| Present Day | Electronic Trading on Stock Exchanges |

Introduction of Electronic Trading Through NSE and BSE

In 1992 with the establishment of the National Stock Exchange (NSE), India saw a major shift from open outcry trading to an electronic or screen-based trading system. This was closely followed by BSE’s launch of its screen-based trading platform BOLT (BSE’s Online Trading System) in 1995.

- 1992: NSE Introduced Electronic Trading

- 1995: BSE Launched BOLT

These systems revolutionized the Indian stock market, providing a transparent and efficient platform, enabling faster transactions and bringing access to even remote parts of India.

Read More : The Game-Changing Impact of Core Banking System (CBS) on India’s Banking Landscape

Emergence of Specialized Stock Exchanges: MCX and NCDEX

The year 2003 marked the development of specialized exchanges. The Multi Commodity Exchange (MCX) was set up for trading in commodities and the National Commodity & Derivatives Exchange (NCDEX) for agricultural commodities.

- MCX: Specifically designed for commodities

- NCDEX: Primarily focus on agricultural commodities

These specialized exchanges played a key role in providing a platform for hedgers, arbitragers, and investors to trade in a wide range of commodities.

The Role of SEBI in Regulating and Developing the Market

The Securities and Exchange Board of India (SEBI) has been the principal regulator of the Indian stock market since its inception in 1988.

- 1988: SEBI was established

- 1992: SEBI was given regulatory powers

SEBI operationalizes laws and regulations to protect the interests of investors, ensure disclosure of information, and maintain fair practices. It also took the initiative to introduce innovative market reforms such as Internet Trading (2000), Securities Lending and Borrowing Scheme (2008), Mobile Trading (2010), and e-IPOs (2015) strengthening the functioning of the Indian market, making it transparent, efficient, and investor-friendly.

The Indian stock market’s journey from under a banyan tree to the digitalized trading platforms and the introduction of specialized exchanges, along with stringent regulations, has played a pivotal role in shaping it into a robust financial powerhouse. This progression reaffirms the dynamic nature of the stock market landscape that continues to adapt to the changing economic and technological realities.

Key Market Players

The Indian stock market ecosystem comprises a wide range of entities, each playing a crucial role in the proper functioning and development of the marketplace.

Stock Market Intermediaries

Intermediaries form a backbone of the stock market, facilitating investor transactions and ensuring smooth trading. Major intermediaries include:

- Stockbrokers: Execute buy and sell orders on behalf of clients on the stock exchange.

- Investment Advisors: Offer expert investment advice to help clients make informed decisions regarding their portfolios.

- Depositories: Maintain investor’s securities in an electronic form, facilitating easy and efficient transfer.

Leading Stock Exchanges

The main stock exchanges driving the Indian stock market are:

- BSE (Bombay Stock Exchange): The oldest stock exchange in India, founded in 1875, is known for its benchmark index, the SENSEX.

- NSE (National Stock Exchange): Established in 1992, the NSE has made significant advancements with its electronic trading platform and offerings, including benchmark index NIFTY.

Apart from these, several regional exchanges, such as Calcutta Stock Exchange, Delhi Stock Exchange, Madras Stock Exchange, serve specific regions across India.

Top Brokerage Firms in India

Various brokerage firms cater to different segments of investors. Some of the leading firms include:

- Zerodha

- ICICI Direct

- HDFC Securities

- Sharekhan

- AXIS Direct

- Motilal Oswal

- Angel Broking

These brokerage firms offer services ranging from online discount broking to full-service stockbroking, meeting diverse investor requirements.

Market Regulators

To ensure a secure and efficient marketplace, strict regulatory oversight is crucial. In the Indian stock market, key market regulators are:

- SEBI (Securities and Exchange Board of India): The primary securities market regulator, SEBI protects investor interests, ensures transparency, and enforces compliance with market regulations.

- RBI (Reserve Bank of India): As the central bank and monetary authority, the RBI plays a vital role in the stability and development of the financial system and oversees risk management and regulatory compliance.

- Ministry of Finance: This government body is responsible for framing policies, regulations, and the overall management of the financial sector, thus enabling a conducive environment for stock market growth.

The Indian stock market comprises various essential entities, ranging from intermediaries and stock exchanges to brokerage firms and regulators. Together, they constitute the robust market infrastructure instrumental in driving economic growth and wealth creation for all stakeholders involved.

Notable Market Crises and Events

The Indian stock market has experienced several crises and events that have reshaped its functioning, exposed vulnerabilities, and led to strengthened regulations.

The Harshad Mehta Scam of 1992

The Harshad Mehta scam revealed the loopholes in the Indian banking system and the stock market. The key highlights of this scam include:

- Exploit of the banking system by using fake bank receipts.

- Manipulation of stock prices, and the consequent rise of the BSE SENSEX.

- A significant crash in the stock market when the scam was exposed.

- Strengthening of regulations: Establishment of SEBI as a statutory body in 1992.

The Ketan Parekh Scam of 2001

Following the Harshad Mehta scam, the Indian stock market was shaken again by the Ketan Parekh scam. The main elements of this scam were:

- Artificial inflation of handpicked stocks known as ‘K-10’ stocks.

- Price manipulation through circular trading.

- Borrowing from the banking system to fund market operations.

- Resulted in reforms to improve corporate governance, transparency, and risk management.

Factors Affecting the Indian Stock Market

The Indian stock market is influenced by various factors, ranging from global events to economic policies. Some notable factors include:

- Global Events:

- The bursting of the dot-com bubble (2000-2002)

- The Global Financial Crisis (2008)

- The impact of the COVID-19 pandemic (2020)

- Economic Policies:

- The liberalization of the Indian economy in 1991: Led to the influx of foreign investments and market integration.

- The introduction of Goods and Services Tax (GST): Indirect tax regime changes impacting businesses in India.

- The ban on high-value currency notes (demonetization) in 2016: Impacted cash-based industries and market sentiment.

- Other Factors:

- Fluctuations in crude oil prices affect industries like aviation, energy, and road transport.

- Currency rate fluctuations impact import/export costs, affecting trade and industries.

- Weather events, such as natural disasters or irregular monsoons, can impact agricultural production, affecting the rural economy and related sectors.

The Indian stock market has witnessed its share of crises and events, which have shaped its regulatory landscape and risk management capabilities. Numerous factors, including global events and economic policies, continuously influence the market dynamics, necessitating constant adaptation and innovation to remain relevant and robust.

Growth of Foreign Portfolio Investment (FPI) and Domestic Institutional Investors (DII) in Indian Stock Market

The Indian stock market experienced substantial growth in both Foreign Portfolio Investment (FPI) and Domestic Institutional Investors (DII) over the years, shaping its trajectory and attracting global interest.

FPI and DII Roles in Shaping the Indian Stock Market

Foreign Portfolio Investment (FPI): Foreign investors purchase Indian stocks or bonds, forming a critical source of capital inflows in the market. Key roles of FPIs are:

- Boosting liquidity: FPIs increase the overall liquidity in the Indian stock market.

- Higher exposure to the global market: FPIs help connect the domestic market with international markets.

- Impact on stock prices: Investments by FPIs can significantly influence stock prices and market sentiment.

Domestic Institutional Investors (DII): These include entities like mutual funds, insurance companies, and pension funds. The key roles played by DIIs are:

- Offering investment opportunities: DIIs provide essential financial instruments and services to retail investors.

- Stabilizing market: DIIs have a stabilizing role by providing a financial cushion during periods of market volatility.

- Deepening the market: DIIs contribute to deepening the market by ensuring that a wider base of investors has access to financial products.

Factors Attracting Foreign Investors to Invest in Indian Equities

Some of the main factors that make Indian equities attractive for foreign investors include:

- Strong economic growth: India has consistently reported robust GDP growth, making it an attractive destination for investment.

- Favorable demographics: With a young and growing population, the demand for goods and services is on the rise.

- Economic policy reforms: Measures like liberalization and “Make in India” initiative have made the country more attractive to foreign investors.

- Large talent pool: India’s skilled workforce has attracted global companies, further bolstering the investment environment.

- Stable political environment: The stable political scenario also encourages foreign investors to participate in the Indian stock market.

Role of Domestic Players

Mutual Funds: The growth of the mutual fund industry has allowed individuals and institutions to access diversified portfolios and professionally managed investments, contributing to increased domestic investment.

Insurance Companies: A significant portion of insurance companies’ funds is invested in equities and debt instruments, stabilizing the market and channeling returns to policyholders.

Pension Funds: Pension funds play a vital role in the long-term investment landscape, facilitating retirement planning for millions of investors while contributing to the market depth.

The growth of FPI and DII in the Indian stock market has played a crucial role in shaping the market’s trajectory, enhancing investor participation, and ushering in long-term growth. It has not only diversified the investment landscape but also provided stability during periods of market volatility.

Technological Advancements and Innovations in the Indian Stock Market

Over time, the Indian stock market has witnessed significant technological advancements and innovations, contributing to increased efficiency, accessibility, and transparency.

Introduction of Electronic Trading and Dematerialization of Shares

Electronic Trading: The shift from a traditional floor-based trading system to an electronic trading platform has revolutionized stock trading in India. Major benefits include:

- Improved trading efficiency: Faster execution of orders with minimal errors.

- Enhanced transparency: Better price discovery and increased market surveillance.

- Wider reach: Electronic trading platforms enable access for retail investors across the country, regardless of geographical location.

Read More : Indian Banking System – Unlocking Opportunities and Overcoming Challenges

Dematerialization of Shares: The transition from physical share certificates to electronic shares has streamlined the trading process. Advantages of dematerialization are:

- Reduced paperwork: Elimination of handling physical share certificates leads to fewer errors and quicker settlements.

- Lower risk: Reduced risk associated with forgery, theft, or loss of physical certificates.

- Easier transferability: Hassle-free transfer of ownership with minimal time and effort.

Growth of Online Trading Platforms and Mobile Apps

With the rise of the internet, several online trading platforms and mobile apps have emerged, offering cost-effective, easily accessible, and user-friendly investment options. Key highlights include:

- Democratization of investing: Retail investors can directly participate in the stock market without hefty brokerage fees.

- Real-time market updates: Investors receive updated market information, allowing them to make informed decisions.

- Customized investment tools: Access to various tools and resources, such as charting, analysis, and research, helps investors make better investment choices.

Adoption of Algorithmic Trading and High-Frequency Trading

Algorithmic Trading: This involves using algorithms to execute trading strategies, taking advantage of market inefficiencies and minimizing human intervention. Key benefits are:

- Speed and accuracy: Quicker execution and reduced risk of manual errors.

- Cost-effectiveness: Trading costs can be minimized through efficient trade execution.

- Mitigation of human emotions: Algorithmic trading ensures discipline by eliminating emotions like greed and fear from the decision-making process.

High-Frequency Trading: A subset of algorithmic trading, it involves placing numerous orders in milliseconds, capitalizing on tiny price discrepancies. High-Frequency Trading provides:

- Market liquidity: Enhances market liquidity by rapidly matching buy and sell orders.

- Arbitrage opportunities: Exploits pricing inefficiencies across different exchanges.

- Improved price discovery: Contributes to more accurate and efficient pricing of securities.

Emergence of Robo-Advisory and AI-based Stock Trading Services

Robo-Advisory: Robo-advisors leverage technology and algorithms to offer personalized investment advice with minimal human intervention. Some benefits include:

- Low-cost advice: Robo-advisory services are more affordable compared to traditional financial advisors.

- Accessibility: Available to a broad range of investors, including new and small investors.

- Data-driven decision-making: Investments are based on data analysis instead of human biases and emotions.

AI-based Stock Trading Services: Artificial Intelligence (AI) is increasingly being used to analyze financial data and develop advanced trading strategies. Advantages include:

- Enhanced risk management: AI algorithms can adapt and learn from market conditions, enhancing risk and portfolio management.

- Complex data analysis: AI can process vast amounts of data quickly, uncovering patterns and trends that humans may not easily detect.

- Predictive analytics: AI-based systems can provide more accurate predictions of market movements and trends.

Technological advancements and innovations have transformed the Indian stock market, making it more efficient, accessible, and transparent. The continued adoption of technology is expected to further fuel industry growth and democratize the investment landscape.

Impact of COVID-19 on the Indian Stock Market

The COVID-19 pandemic has had significant repercussions on the global economy and the Indian stock market, presenting challenges as well as opportunities. Several sectors experienced downturns, while others experienced a boost due to changing circumstances.

The Market Crash and Subsequent Recovery During the Pandemic

The onset of the pandemic saw a rapid decline in global and Indian stock markets due to uncertainty, fear, and business disruptions. However, the market recovery has been swift, driven by various factors like:

- Central banks’ intervention: Aggressive monetary policy measures, such as cuts in interest rates and liquidity injection, helped restore investor confidence.

- Fiscal stimulus packages: Governments around the world, including India, announced stimulus packages to support businesses and revive economies.

- Positive news on vaccine development: Successful clinical trials and mass vaccination programs injected optimism into the markets.

Work-from-Home Culture and Its Impact on IT and Telecom Sector Stocks

The shift to remote working accelerated due to the pandemic, and this has had significant implications for the IT and telecom sectors. Major impacts include:

- IT Sector:

- Increased demand for digital services: Businesses ramped up their digital transformation initiatives to facilitate remote working, boosting the IT sector.

- Enhanced cloud computing adoption: The need for remote data storage and access led to a surge in demand for cloud-based solutions.

- Growth in IT stocks: Indian IT companies have seen increased revenues and profitability, leading to a growth in their stock prices.

- Telecom Sector:

- Higher data usage: Remote working, online education, and entertainment increased the demand for internet services.

- Broadband expansion: Telecom companies had to strengthen their infrastructure to cater to the growing demand for connectivity.

- Mixed impact on stocks: The IT and telecom sector witnessed stock prices growth, attributed to the enhanced demand for services, though some companies experienced financial stress due to high levels of debt.

Pharma Sector Boom Led by COVID-19 Vaccine Development

The pharmaceutical sector experienced a significant boost due to the pandemic. Key developments include:

- Focus on vaccine research: The rapid development of COVID-19 vaccines, like Covaxin and Covishield, provided a thrust to the Indian pharmaceutical industry.

- Growth in demand for medical supplies: The pandemic led to an increase in demand for essential medical supplies like personal protective equipment (PPE), sanitizers, and medicines.

- Strong stock market performance: Pharma companies involved in vaccine development or the manufacturing of essential medical supplies have seen their share prices appreciate considerably during the pandemic.

The COVID-19 pandemic has had a profound impact on the Indian stock market, causing a market crash followed by a rapid recovery, with several sectors like IT, telecom, and pharma benefiting from the evolving situation.

The Journey to All-Time Highs and Future Prospects

The Indian stock market has experienced a remarkable recovery after the COVID-19-induced crash, reaching new all-time highs. Various factors contributed to this phenomenal growth, and emerging sectors are expected to play a significant role in shaping the market’s future outlook.

Factors That Led to the Recent All-Time Highs

- Central banks and government intervention: Aggressive monetary policies, stimulus packages, and liquidity infusion from central banks have restored investor confidence and fueled the market’s upward trajectory.

- Vaccine optimism: Successful vaccine development and mass vaccination drives have led to optimism about a quicker economic recovery.

- Increased retail participation: The pandemic has witnessed a surge in retail investor participation, driven by easy access to online trading platforms and increased savings due to reduced spending on non-essential items.

- Earnings recovery: Many companies have reported better-than-expected earnings, despite the pandemic, signaling a strong recovery and resilience across various industries.

- Global market rally: The Indian market benefited from the overall improvement in global sentiment as markets around the world rebounded from the pandemic lows.

Role and Expectations from Emerging Sectors: Electric Vehicles, Renewable Energy, and E-Commerce

- Electric Vehicles (EVs): The government’s push for reducing emissions and improving sustainability, along with favorable policies, is expected to boost the adoption of EVs. This presents substantial growth opportunities for EV manufacturers, battery producers, and charging infrastructure companies.

- Renewable Energy: India has set ambitious renewable energy targets, including a goal to achieve 175 GW of renewable energy capacity by 2022. This sector has significant potential for growth, driven by advancements in solar and wind energy technologies, declining costs, and supportive government policies.

- E-Commerce: The pandemic has accelerated the digital adoption in commerce, leading to a surge in online shopping, digital payments, and logistics services. The rapid expansion of the e-commerce sector presents promising prospects for companies involved in the e-commerce ecosystem, including online retailers, payment solution providers, and supply chain management firms.

Investor Sentiment, Earnings Growth, and Global Influences: The Path Ahead

- Investor sentiment: Continued optimism around economic recovery, supported by vaccine distribution and government stimulus packages, is expected to drive positive investor sentiment in the near term.

- Earnings growth: Corporate earnings are expected to grow as businesses rebound from the pandemic-ravaged year and adapt to the new normal. Improving earnings will be crucial for sustaining stock market gains.

- Global influences: Factors like the U.S. Federal Reserve’s policies, global interest rates, and geopolitical events can impact the Indian stock market. Investors need to stay vigilant of these global factors while making investment decisions.

- Sector diversification: Investors should keep an eye on emerging sectors, such as EVs, renewable energy, and e-commerce, which have the potential to bolster the market’s future growth trajectory.

The Indian stock market’s journey to all-time highs has been driven by various factors, including central bank interventions, vaccine optimism, and resilient corporate earnings. Keeping an eye on emerging sectors and staying informed of global influences will be essential as investors and traders navigate the path ahead.

In Conclusion: A Recap of the Indian Stock Market Journey and Future Prospects

In summary, the Indian stock market has undergone remarkable transformations, such as the adoption of electronic trading, the integration of technological innovations like algorithmic trading, and the online accessibility provided by trading platforms and mobile apps.

The COVID-19 pandemic presented both challenges and opportunities for the market, with a crash followed by a swift recovery, largely driven by central banks’ intervention, fiscal stimulus packages, and vaccine optimism. The work-from-home culture has particularly benefited IT and telecom sector stocks, while the pharma sector has experienced significant growth due to vaccine development efforts.

As the market surges to all-time highs, emerging sectors like electric vehicles, renewable energy, and e-commerce will play a crucial role in shaping the future of the Indian stock market.

That said, it is vital for an investor like yourself to remain vigilant and stay updated on market trends, global influences, and emerging sectors to make informed investment decisions. Furthermore, embracing responsible investing and focusing on long-term wealth creation can contribute to personal financial growth and the country’s economic development.

Let’s stay connected during this remarkable financial journey and make the best of the opportunities this evolving market presents! Happy investing!

6 thoughts on “Indian Stock Market – Origin , Regulation, FPI , DII | Indian Stock Market At Record High; Sensex Hits 64,000-Mark, Nifty transcends 19,000 points”